For years, the conventional wisdom has been simple: the Federal Reserve cuts rates, mortgage costs fall, and home prices rise. But there’s a growing body of evidence, and a very different framework from economist Richard Werner, suggesting the causality runs the other way. If you buy Werner’s argument that interest rates follow the economy instead of leading it, then a rate cut on its own may do little to boost prices when credit is tightening and growth is soft.

Werner’s Lens: Credit First, Rates Second

Werner’s “Quantity Theory of Credit” places credit creation by banks at the heart of economic cycles. In this view, when banks expand lending into the real economy, activity and asset prices rise; when they pull back, growth and prices weaken regardless of where the Fed sets rates.

Werner summarizes it bluntly: interest rates aren’t the steering wheel; they’re the speedometer they tend to follow the economy rather than lead it. His research shows that lower policy rates are not reliably linked to faster growth and can even be ineffective if credit conditions remain tight.

Why a Rate Cut May Not Lift Prices This Cycle

Two practical reasons support Werner’s view right now:

- Credit Standards Remain Tight. Recent lending surveys show banks are maintaining stricter approval requirements. Even if rates drop, limited access to financing can prevent buyers from entering the market.

- Loan Growth Is Weak. Data on overall bank lending shows sluggish credit creation hardly the backdrop for a housing rebound, even if the Fed trims rates.

Bottom line: If credit isn’t expanding into housing, the “transmission” from a Fed cut to higher home prices can slip.

Scottsdale & Paradise Valley: A Massive Run-Up Sets the Stage

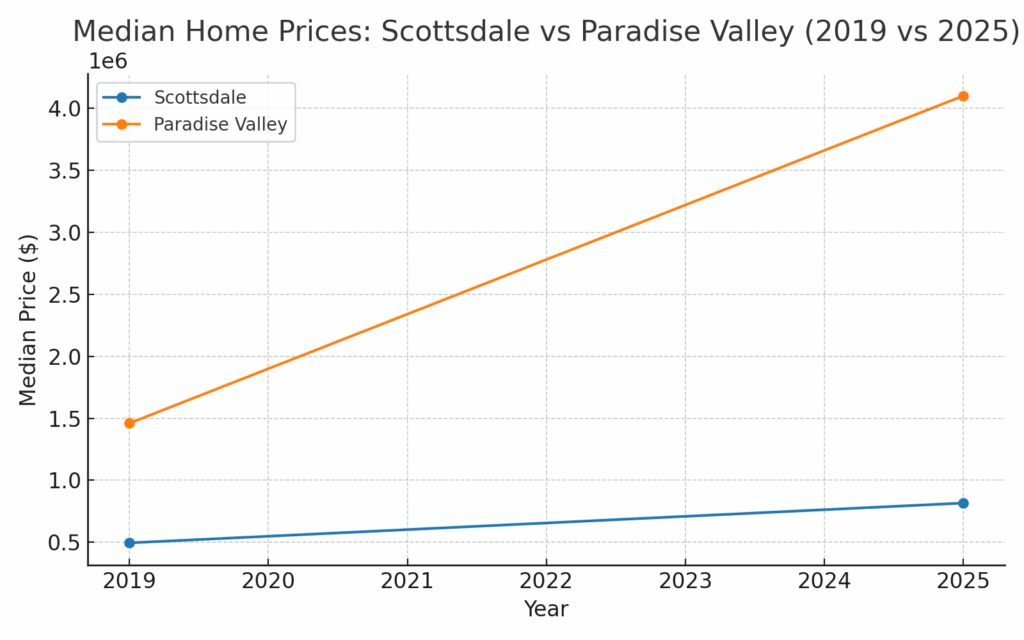

Zoom into our backyard, and the numbers speak for themselves:

- Scottsdale. In 2019, the median sale price hovered near $495,000. As of mid-2025, that number has climbed to roughly $816,000 an increase of about 65% in just six years.

- Paradise Valley. Back in 2019, the median price was about $1.46M. Today, it’s closer to $4.1M nearly triple in the same period.

These are extraordinary gains, driven by stimulus, migration, constrained supply, and a surge in wealth effects. Werner’s framework would call this a credit-fueled upswing. The risk now? If credit creation into housing slows or reverses, prices can correct even with lower rates.

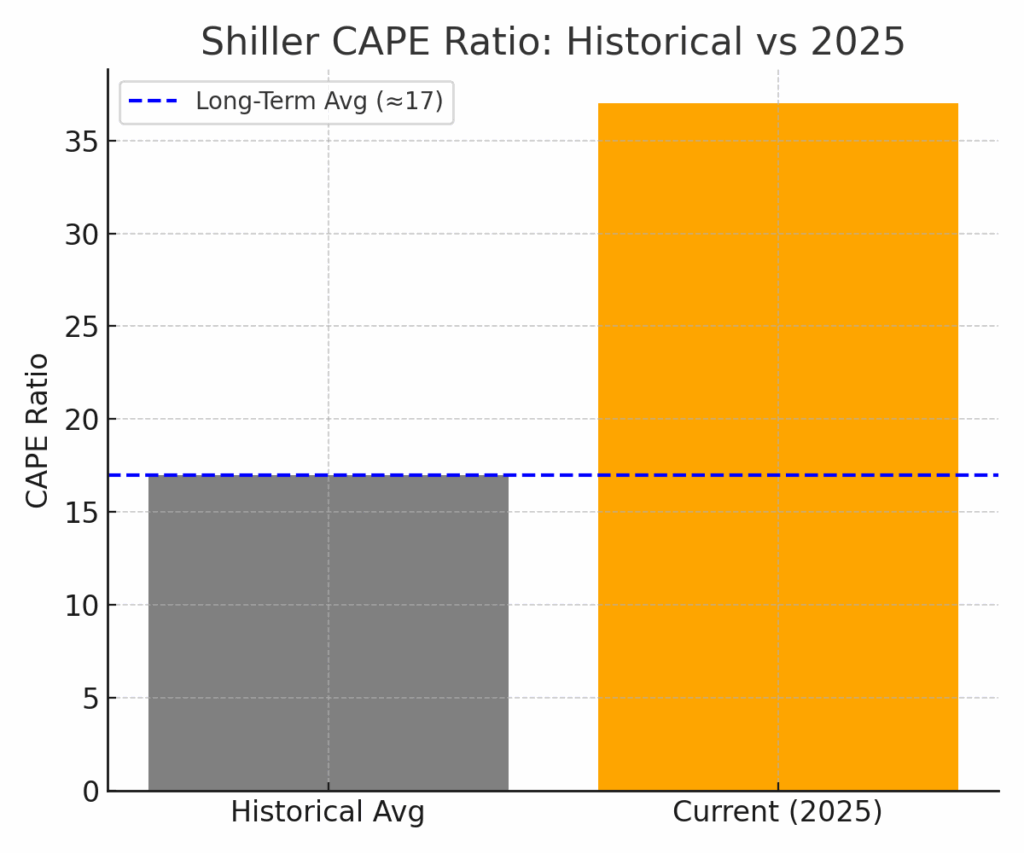

The Valuation Headwind from Stocks (CAPE)

Housing doesn’t exist in a vacuum. Wealth effects from the stock market play a significant role in high-end areas like Paradise Valley and North Scottsdale. Today, the Shiller CAPE ratio sits in the high-30s, far above its long-term average of around 17. The Shiller CAPE ratio, also known as the cyclically adjusted price-to-earnings ratio, is a valuation measure that uses real earnings per share over a 10-year period. Historically, a high CAPE ratio signals stretched equity valuations and raises the odds of weaker forward returns. If equities pull back, luxury housing demand could cool alongside them.

If Werner Is Right, What Comes Next?

Under a “credit first” lens, three drivers matter far more than the Fed’s next move:

- Bank Lending Standards & Loan Growth. If lenders remain cautious and borrowers stay hesitant, nominal prices could stagnate or decline even if mortgage rates ease.

- Local Supply–Demand Balance. Scottsdale inventory levels have climbed, and days on market are lengthening, creating more leverage for buyers. This means that there are more homes available for sale, and they are staying on the market for longer periods, giving buyers more options and potentially more negotiating power. Paradise Valley remains volatile, and even small shifts in demand can lead to big swings in pricing.Wealth Effects from Equities. With stock valuations stretched, any significant re-rating in markets could dampen housing demand, especially in the luxury segment.

What This Means for Buyers and Sellers

For Buyers: Don’t chase rate headlines. Focus on affordability, inventory, and negotiation leverage. With more homes available and credit creation slowing, there may be opportunities to secure better pricing if you stay patient and well-prepared. This advice empowers buyers to make informed decisions. For Sellers: Price to today’s demand, not yesterday’s peak. Scottsdale and Paradise Valley have seen unprecedented appreciation since 2019, which means buyers are more selective now. Waiting for a Fed cut to “rescue” prices is risky, data suggests credit conditions will dictate the real driver of housing activity. This caution is to prevent sellers from feeling rushed into making decisions.

The Takeaway

A rate cut can provide some relief at the margins, but credit creation, income growth, and risk appetite are the real levers behind housing prices. Werner’s research, and today’s lending dynamics suggest that lower rates alone are unlikely to restart a broad price upswing if banks remain cautious.

With Scottsdale up nearly 65% and Paradise Valley almost tripling since 2019, the next chapter could bring a valuation reset or at least a prolonged sideways grind especially if the stock market, supported by historically high CAPE levels, starts to cool.