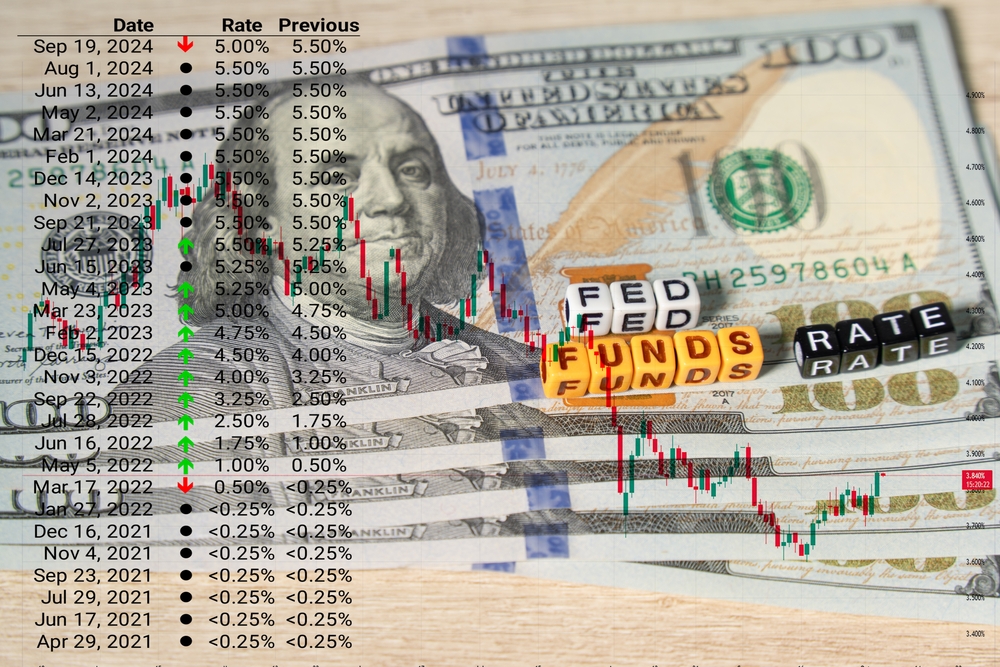

For months, buyers, sellers, and investors have been watching the Federal Reserve’s next move, anticipating a probable cut in the Fed Funds rate. The hope is simple: lower rates mean cheaper mortgages and a reinvigorated housing market.

However, the situation is far more intricate. Even if the Fed decides to cut, the reduction in mortgage rates may not be as significant as many are hoping for. The Scottsdale, Paradise Valley, and the Metro Phoenix area may not experience the surge in activity that some are predicting. This is because policy rates are just one part of the puzzle; the fundamental drivers are the money supply (M2) and credit creation.

The Pandemic Surge and Today’s Housing Reality

Since 2020, housing in Scottsdale and Paradise Valley has experienced unprecedented price acceleration:

- Scottsdale’s median home price has surged 60%+ since 2020

- Paradise Valley’s average price has more than doubled in some luxury pockets

- Buyer affordability has reached its lowest levels in more than two decades

This boom wasn’t purely organic; near-zero interest rates, pandemic-driven migration, and an unprecedented flood of liquidity from policymakers fueled it. However, now that tailwind has shifted, a potential Fed cut is unlikely to recreate those conditions.

Steve Hanke: Follow the Money Supply, Not the Fed

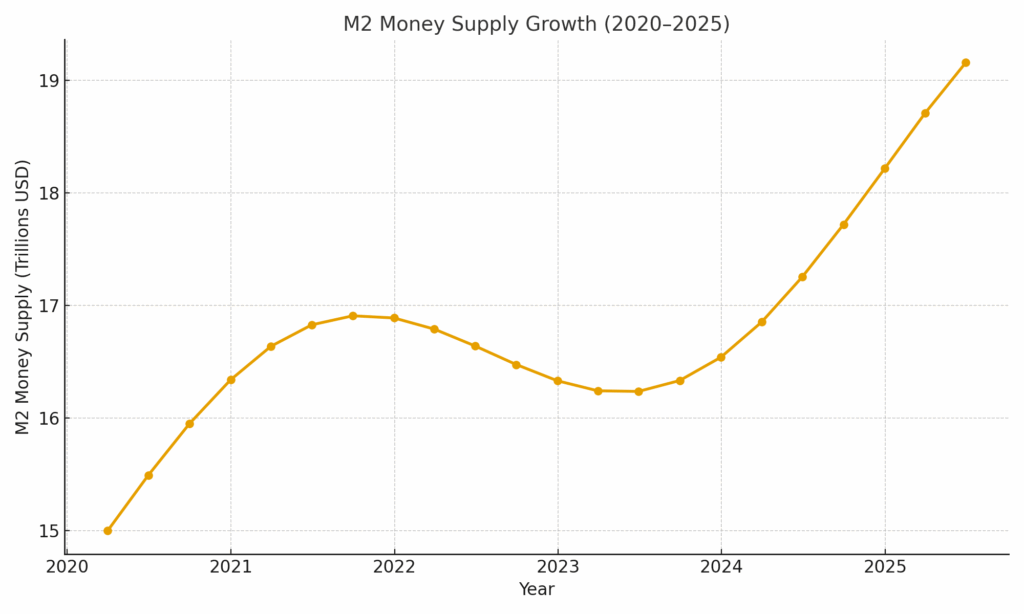

Economist Steve Hanke argues that if you want to predict where the housing market is headed, follow M2, not the Fed.

- Between 2020 and 2021, M2 grew by over 40%, pumping trillions into the economy.

- That surge in liquidity created easy credit, fueled speculation, and pushed prices skyward.

- Over the past 18 months, however, M2 has contracted for the first time in decades, signaling tighter credit, reduced purchasing power, and less capacity for price growth.

Richard Werner: Credit Creation Drives Bubbles and Corrections

Economist Richard Werner, author of Princes of the Yen, takes the analysis one step further. He argues that asset bubbles are created when banks issue abundant credit, and when that credit slows, bubbles must deflate.

- In recessionary environments, banks pull back on lending to reduce risk exposure.

- Less credit = fewer qualified buyers, smaller loans, and reduced upward pressure on prices.

- Even a 1% Fed Funds rate cut may have little impact if credit creation continues to contract.

Mortgage Rates, Home Prices & Reality Check

Here’s why lower Fed rates may not bring the relief buyers are hoping for in Metro Phoenix:

- Mortgage rates remain sticky, even when the Fed cuts, the spread between Treasury yields and 30-year mortgages remains wide, as lending conditions are still tight.

- Home prices have far outpaced income growth, keeping affordability near 20-year lows.

- Without stronger credit expansion, buyer demand cannot sustainably absorb today’s price levels.

Market Watch Indicators

If you want to stay ahead of market shifts, here are four key indicators to watch in the coming months:

- M2 Money Supply Trends — Ongoing contraction signals slower demand and liquidity tightening.

- Credit Creation & Bank Lending Data — Track loan approval volumes and lending standards.

- Mortgage Rate Spreads — Watch the gap between the 10-year Treasury and 30-year fixed rates.

- Inventory Levels — A rising months’ supply in Scottsdale and Paradise Valley is a leading indicator of future price adjustments.

Sources

- Federal Reserve Bank of St. Louis (FRED) – M2 Money Stock (M2SL) dataset, showing levels and YoY growth.

- Steve Hanke & John Greenwood – “Central Bankers Have It Wrong: Money Growth Still Sets the Pace of Nominal GDP” (Cato Journal, 2023).

- Richard Werner – Princes of the Yen and his academic research on credit creation.

- S&P Dow Jones Indices – S&P CoreLogic Case-Shiller U.S. National Home Price Index, used for context on post-2020 home price inflation.

Key Takeaway

The upcoming Fed rate cut will make headlines, but it’s unlikely to deliver the instant affordability many hope for. Shrinking M2 money supply, reduced credit creation, and post-pandemic price inflation are reshaping the Scottsdale and Paradise Valley markets.

For buyers, sellers, and investors, this isn’t a time for a passive ‘wait and see’ approach it’s a time to be proactive, strategic, and data-driven in your decisions. Your actions will play a crucial role in shaping the future of the market.