For years, headlines have warned that homeownership is becoming a distant dream—especially for younger generations. Rising prices, student debt, and tighter inventory have all contributed to the perception that owning a home is simply out of reach for Millennials and Gen Z. But is that fear truly backed by the data?

Let’s take a closer look at the long-term homeownership trend in America and break it down by generation.

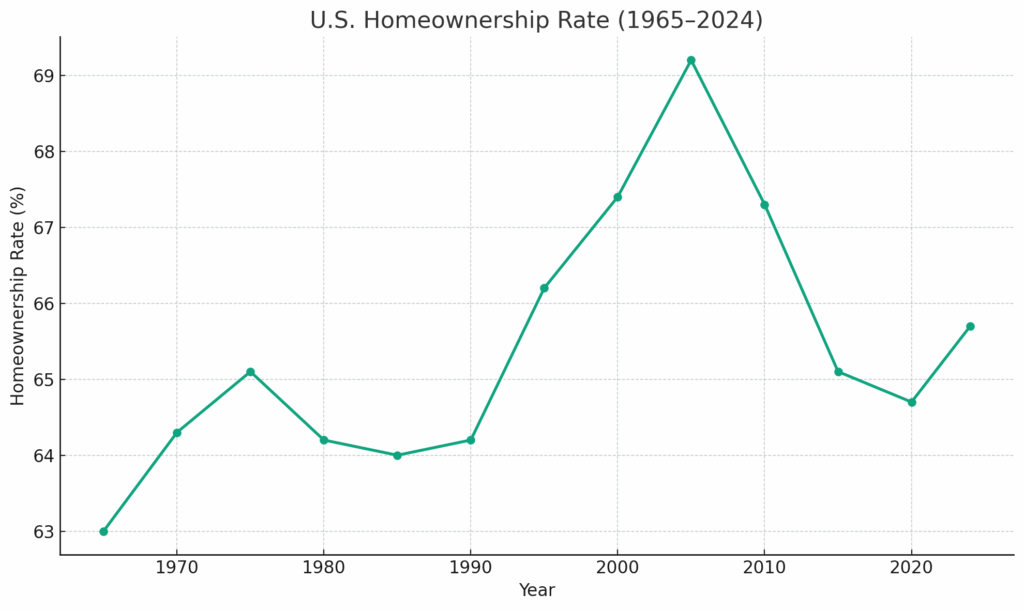

Overall U.S. Homeownership Rate Since 1965

Despite the economic cycles, the U.S. homeownership rate has shown remarkable resilience over the past six decades. The rate, as per the U.S. Census Bureau, reached its peak at 69.2% in 2004, dipped after the 2008 housing crash, and has since bounced back to around 65.7% in 2024, just slightly below the long-term average. This stability is a testament to the enduring strength of the housing market.

This doesn’t signal a collapse. But to understand the picture, we need to examine who is buying—and who isn’t.

Who Are We Talking About? Generational Definitions Matter

To analyze trends clearly, let’s define the generational groups often referenced in the media:

- Baby Boomers: Born 1946–1964

- Generation X: Born 1965–1980

- Millennials: Born 1981–1996

- Generation Z: Born 1997–2012

Each of these groups has faced a unique housing market shaped by economic shifts, interest rate cycles, and social changes.

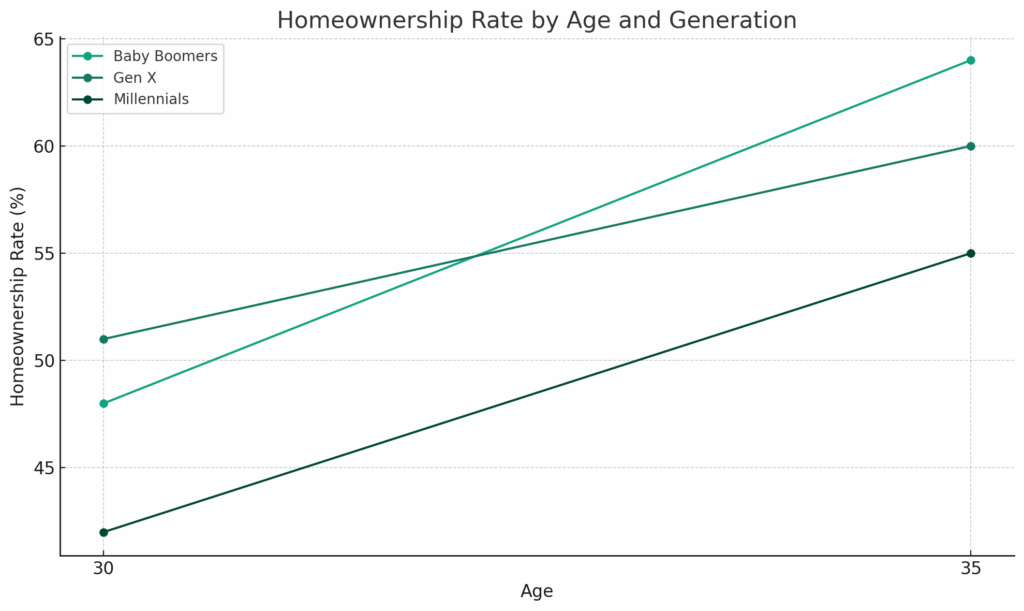

Homeownership by Generation

Millennials did trail earlier generations in homeownership milestones. By age 30, only about 42% of Millennials owned homes, compared to 51% of Gen X and 48% of Baby Boomers at the same age.

However, the gap is gradually narrowing. As of 2024, over 51% of Millennials are proud homeowners. Many seized the opportunity presented by historically low interest rates during 2020–2022. While they may have delayed their entry into the market, they certainly did not miss the boat. This progress is a cause for optimism, showing that with the right conditions, homeownership is within reach.

Gen Z is still early in their homeownership journey. But there are signs they may start earlier than Millennials did—often with family help or by buying in more affordable markets, such as [specific affordable markets]. These markets, with their lower home prices and more favorable financing options, are becoming increasingly popular among younger buyers.

What’s Holding Younger Buyers Back?

Several challenges continue to affect first-time buyers:

- Affordability: Home prices have outpaced wages in many markets.

- Low Inventory: Especially in starter-home price points, supply is tight.

- Student Debt: For Millennials, loan payments have particularly delayed buying a first home.

- High Interest Rates: Many would-be buyers are waiting for more favorable financing.

Still, it’s not all bad news. In 2024, first-time buyers made up 32% of all purchases, a slight improvement from previous years.

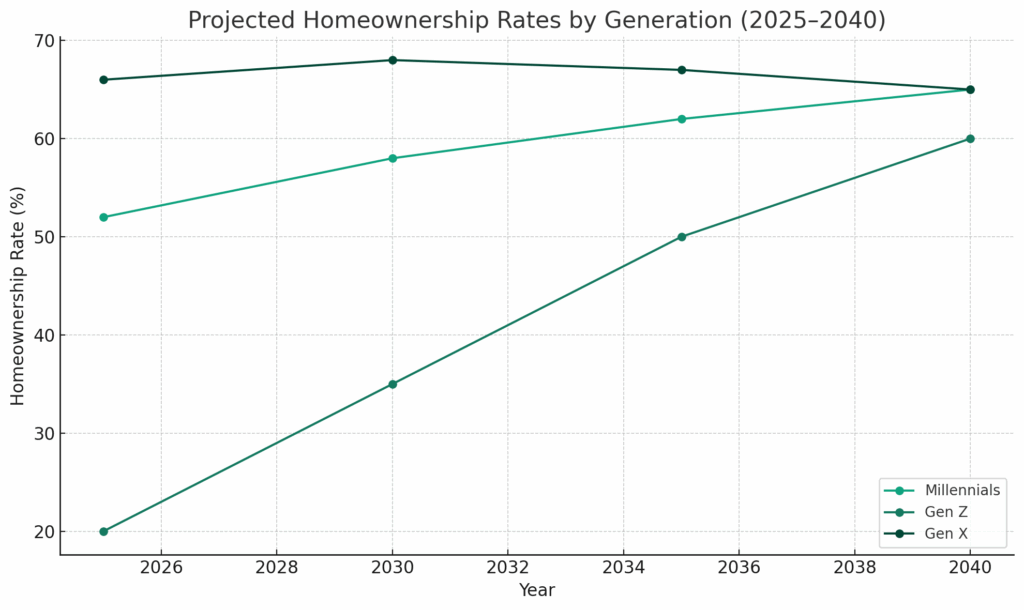

Projected Future Homeownership Rates

Looking ahead, economists project a stable national homeownership rate of 63% to 66% over the next decade. As Baby Boomers transition out of homeownership, their homes are expected to become available to younger buyers. Intergenerational wealth transfers and market corrections could further facilitate the entry of Gen Z into the market. This future outlook should instill hope and confidence in potential buyers.

Bottom Line: Late, Not Lost

While it’s true that younger generations have faced more barriers, the long-term picture isn’t as bleak as some headlines suggest. Millennials are now the majority of homeowners, and Gen Z is slowly entering the market with caution and better financial tools.

The American dream of homeownership is evolving—not disappearing.

Final Thought

If you’re a younger buyer wondering if homeownership is still possible, the answer is yes—with a brilliant plan and clear guidance. Consider aligning yourself with a professional Buyer’s Broker who’s experienced in all market conditions. As a homeowner preparing to sell, understanding the next wave of buyers can help you market your property effectively. For instance, following the advice and guidance of a “battle-tested” Listing Broker who has a strategic plan can be highly beneficial.

Need help navigating the path to ownership or preparing your home for sale? Let’s talk.