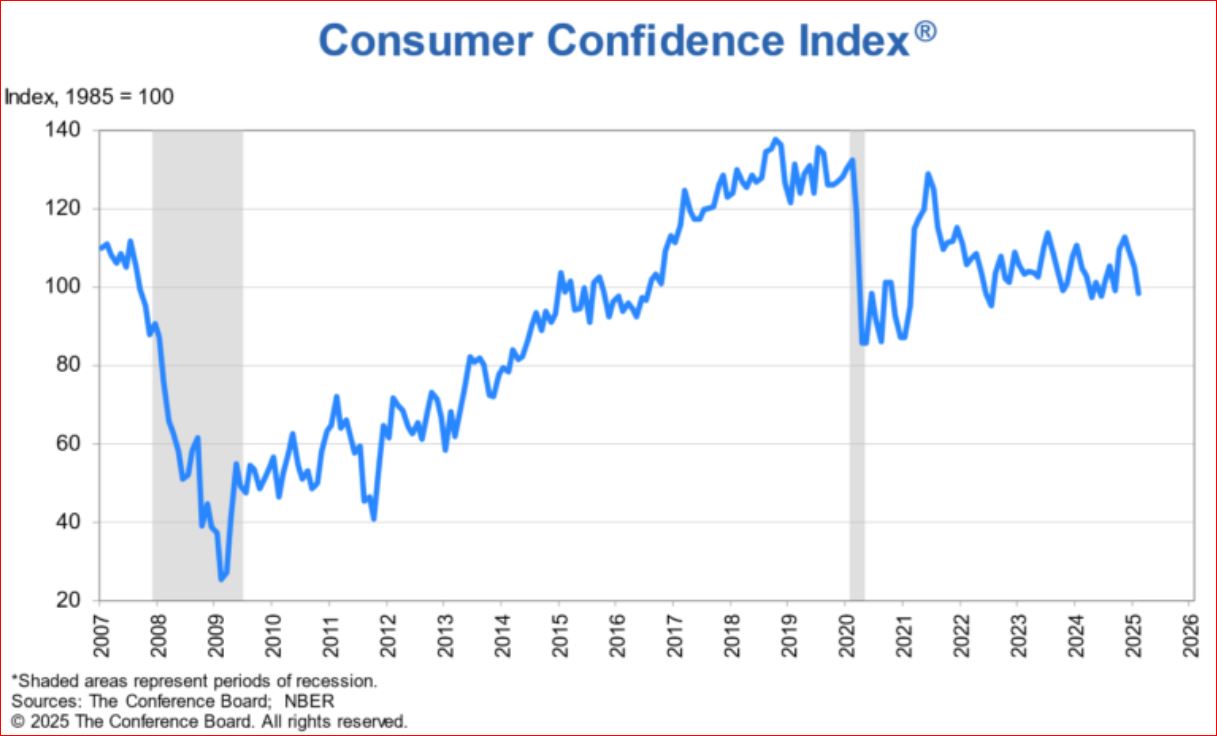

The U.S. Consumer Confidence Index just posted its sharpest drop in nearly two years, falling to 86.0 in April 2025 — almost 8 points from March. For context, that’s the lowest consumer sentiment reading since May 2020, during the early months of the pandemic. And while this kind of economic indicator may sound abstract, it’s historically been a clear signal that significant shifts could be coming in residential real estate.

What Exactly Is the Consumer Confidence Index?

The Consumer Confidence Index (CCI) measures how optimistic Americans feel about their finances, job prospects, and the broader economy. It’s compiled by The Conference Board, based on survey responses from a cross-section of U.S. households.

The CCI has two main components:

- Present Situation Index – how people feel about business conditions and today’s job market.

- Expectations Index – how they expect those things to look six months from now.

When confidence is high, people are more likely to make big purchases, like homes. When confidence falls, spending tends to slow, often including homebuying.

In April, the Expectations Index dropped to 54.4 — well below the recession warning threshold of 80. That level hasn’t been breached since 2011 and typically signals rising concerns about job security, wages, and inflation.

A Pattern We’ve Seen Before

If this sounds familiar, it should. Consumer confidence dropped sharply before both the Great Recession and the COVID-19 housing slowdown:

- In February 2009, the index fell to a record-low 25.3 at the depths of the financial crisis, just as home prices were bottoming out.

- In April 2020, confidence tumbled to 85.7, as lockdowns and uncertainty stalled the housing market almost overnight.

While today’s economy is in far better shape, the trend line is unsettling — and worth watching closely.

Why This Matters for the Housing Market

So why does consumer confidence affect home sales? Because buying a home is about more than mortgage rates — it’s about how people feel about their financial future. If potential buyers are nervous about their jobs, hesitant about inflation, or unsure about the broader economy, they tend to wait. Even buyers who can afford to move may stay put until the outlook improves.

That’s precisely what happened during past downturns, and we may be seeing early signs of that pattern again. In April, pending home sales in several significant markets slipped, and homebuyer sentiment, as measured by Fannie Mae’s Housing Index, also fell for the third straight month.

Buyers may become more cautious in markets like Scottsdale, Paradise Valley, and Metro Phoenix, where prices have surged over the last few years. Even if interest rates stay flat, emotional factors could cause a meaningful slowdown in activity this summer.

What’s Behind the Confidence Drop?

Several headwinds are at play:

- Tariff pressures: Washington’s new trade actions are making headlines again, reviving concerns about inflation and global uncertainty.

- Economic contraction: The U.S. economy shrank by 0.3% in Q1 2025, a mild decline, but enough to get the attention of Wall Street and Main Street alike.

- Stubborn inflation: While inflation has cooled from its highs, many consumers still feel squeezed at the grocery store, gas pump, and monthly housing costs.

These combined pressures are making Americans feel less secure, and when they feel less secure, they tend to put off major life decisions.

What Happens Next?

If consumer confidence continues to fall, we could see a ripple effect in residential real estate:

- Fewer buyers are entering the market.

- Longer days on the market for listings.

- There is a greater need for pricing strategy adjustments, especially in mid-to-high price ranges.

- Slower momentum in luxury and second-home markets.

For now, the housing market remains resilient, but buyer behavior could shift quickly if consumer sentiment continues to slide.

Bottom line: A drop in consumer confidence doesn’t immediately crash the housing market but often signals what’s coming. If you’re considering buying or selling, it’s worth keeping a close eye on how Americans feel. Because when confidence drops, housing demand usually follows.