If you want a clean way to understand why housing felt like it re-priced in the 2020s, look at two Arizona markets that normally behave very differently:

- Paradise Valley: a luxury, privacy-driven, low-turnover market where scarcity is structural

- Scottsdale: a broader lifestyle and employment-adjacent market with more price tiers, but still persistent supply limits

From the end of 2019 through the end of 2025, both moved sharply higher, but Paradise Valley’s move was the most dramatic. And the reason matters for what comes next.

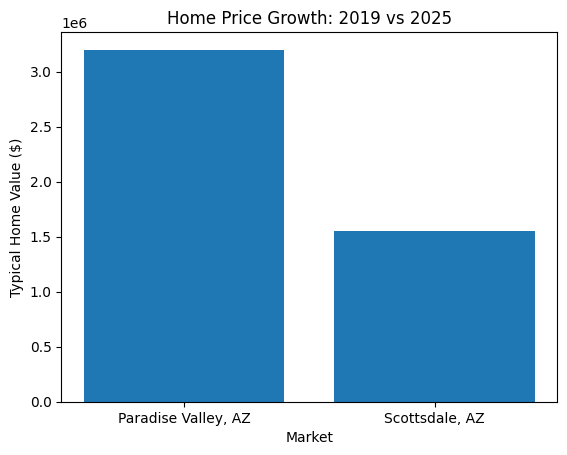

The simple scoreboard: end of 2019 vs. end of 2025

To keep comparisons practical rather than theoretical, this uses commonly cited market benchmarks (single-family median prices and “typical value” proxies referenced by Zillow, Redfin, and local market reports).

| Paradise Valley 2019 →2025→ % Change | $1,200,000 | $3,200,000 | +167% |

| Scottsdale 2019 →2025→ % Change | $650,000 | $1,550,000 | +138% |

What this tells you immediately:

These markets didn’t just appreciate. They reset to a higher valuation band, driven by forces larger than local job growth or population alone.

Follow the money: liquidity reshaped asset pricing.

Housing prices don’t move in isolation; they move inside a financial system.

From late 2019 through 2025, the U.S. experienced a once-in-a-generation expansion of liquidity, with M2 money supply rising roughly 45% at its peak. The sharpest acceleration occurred early in the cycle, setting the stage for asset repricing.

That matters because excess liquidity tends to surface first in scarce, long-duration assets:

- equities,

- real estate,

- and tangible “store-of-value” assets.

Luxury and lifestyle housing fits that profile perfectly.

How liquidity actually flowed into Scottsdale & Paradise Valley

This wasn’t one single force; it arrived through several reinforcing channels.

1) Cheaper capital rewrote buying power

Early-cycle rate compression didn’t just help primary buyers; it amplified purchasing power across investors, second-home buyers, and move-up households. When the cost of money falls, long-duration assets reprice upward.

2) Lifestyle re-prioritization changed “value”

Remote and hybrid work altered how buyers evaluated space, privacy, and climate. Paradise Valley benefited disproportionately: low density, views, security, and architectural customization became premium attributes rather than luxuries.

3) Wealth effects expanded the buyer pool

Rising equity markets, business exits, and concentrated wealth creation produced a class of buyers less sensitive to mortgage rates, particularly in the $2M+ segment.

The accelerant: investor capital entered the single-family equation

Investor participation in single-family housing rose meaningfully during the pandemic era and remained elevated into the mid-2020s.

While large institutions were not the majority of buyers, they didn’t need to be. In tight-supply markets, consistent, well-capitalized participation changes pricing dynamics by:

- tightening competition,

- reducing friction to close,

- and reinforcing higher valuation floors.

In Scottsdale, this was most visible in rental-viable neighborhoods.

In Paradise Valley, it appeared more subtly through capital treating luxury homes as durable wealth stores rather than just residences.

Luxury housing’s structural shift: from shelter to value store

By 2025, high-end housing increasingly functioned as:

- a scarcity-backed hard asset,

- a usable lifestyle good,

- and a balance-sheet allocation.

Paradise Valley exemplifies this shift:

- extreme supply constraints,

- zoning and lot-size barriers,

- and limited turnover.

Once enough capital treats housing this way, markets don’t revert cleanly to prior valuation norms, even when activity slows.

Why prices held up despite “higher-for-longer” rates

If mortgage rates alone dictated prices, 2025 should have seen sharper declines. Instead, many segments stayed firm because:

- Locked-in supply is real; owners with sub-4% mortgages aren’t motivated sellers.

- Cash and equity-rich buyers dominate the top end.

- Investors adapt rather than exit, especially where long-term scarcity still pencils.

The result was a sticky market: fewer listings, fewer forced sales, and resilient pricing in premium locations.

Soft outlook: why pressure still tilts upward (not straight up)

A realistic read for 2026 and beyond is continued upward bias with uneven movement, depending on price tier and micro-location.

Why does the long-term bias remain up?

- Supply constraints in Paradise Valley are structural.

- Scottsdale remains a high-amenity, high-inflow metro.

- Housing’s role as a wealth-preservation asset is now embedded.

- Investor participation is a standing feature, not a one-cycle anomaly.

What could interrupt the path?

- a broad recession with wealth destruction,

- a deep equity drawdown,

- targeted regulation of investor activity,

- or meaningful new supply (unlikely in PV; selective in Scottsdale).

Bottom line

The 2019 market was priced for a different monetary regime and a different buyer mix.

The 2025 market is priced for scarcity, wealth concentration, and optionality.

That doesn’t mean housing is “cheap.”

It explains why the downside has been far harder to realize than many expected, especially in markets like Scottsdale and Paradise Valley, where scarcity isn’t cyclical; it’s structural.